Project Finance

Key Facts

Project finance and construction finance with Bank Guarantees. Are the costs justified?

Securing a cheaper bank loan using a bank guarantee as collateral is a good deal for companies that have been refused loans or credit lines. The initial cost can seem expensive but as soon as the collateral transfer agreement is utilised to secure a favourable loan the cost of lending can be significantly better than that which the company could achieve ordinarily.

Did you know that Bank Guarantees can be used for project finance from hotels to wind farms and solar power to mining? However, for many companies finding project or construction finance can be very difficult.

We can make an

introduction

We can introduce you to boutique finance companies that specialise in delivering corporate funding.

Free document download

facility

We have a range of useful documents and information to assist you with gaining finance for your projector company.

We can answer your

questions

We answer your questions in relation to Bank Guarantees. Click here to get the answers you need to make an informed decision.

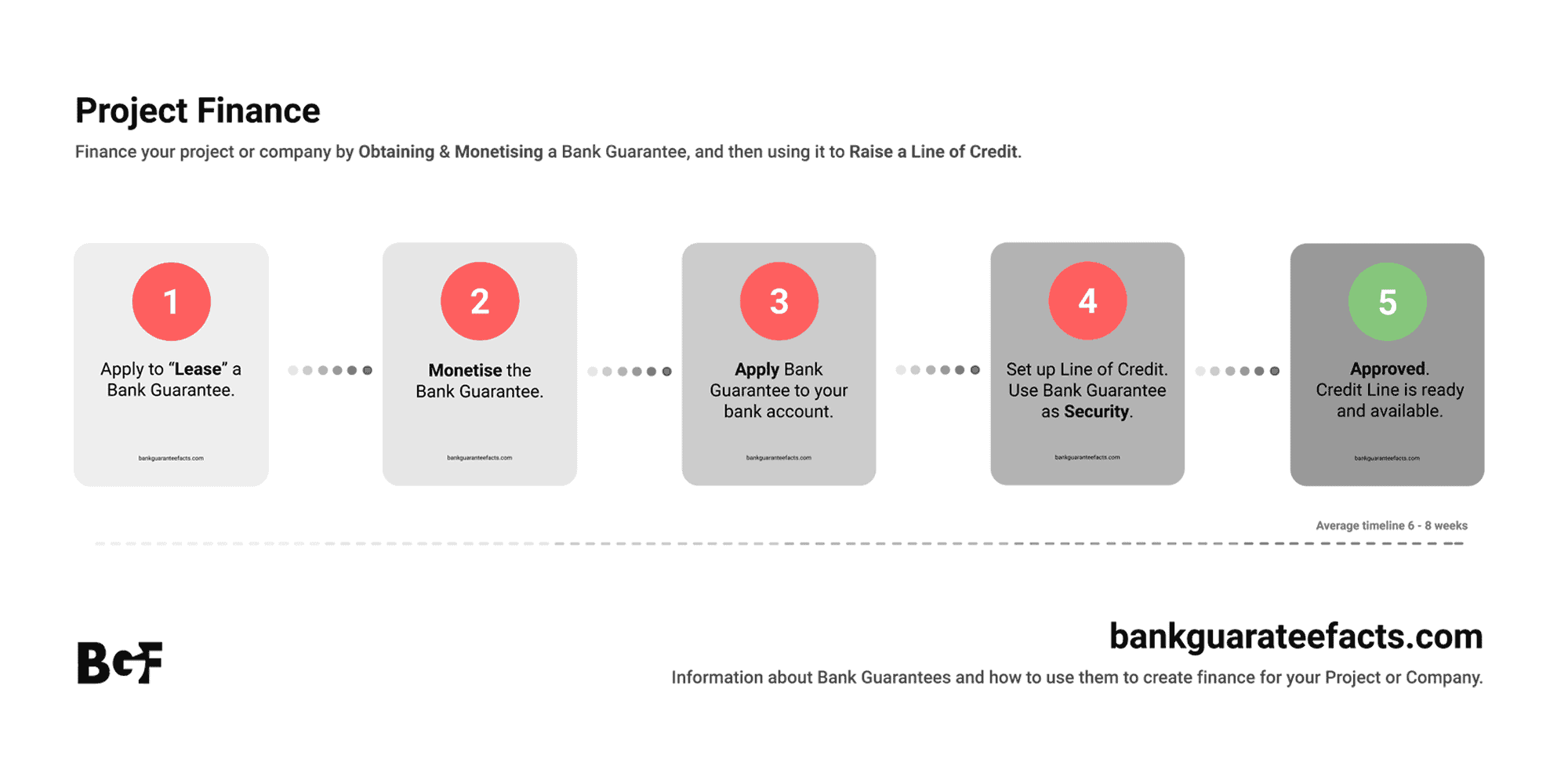

Project financing from a Bank Guarantee

For those not in the know, a Bank Guarantee is utilised not just for the usual banking facilities such as a customs guarantee, a performance guarantee or an advance payment guarantee to mention but a few.

There is one specific Bank Guarantee, which contains extremely precise and explicit verbiage that can be monetised and used as collateral for a credit line. This guarantee is referred to as a Demand Bank Guarantee. The technical term for such a transaction is known as Collateral Transfer but many may recognise the non-technical term as a Leased Bank Guarantee.

Collateral Transfer is the method whereby one company, usually referred to as the Beneficiary leases a Demand Bank Guarantee from another company, referred to as the Provider

For in-depth information on Providers and how to obtain credit lines from Demand Bank Guarantees, please click the relevant links.

What comes next

If a company is being turned down for project finance or construction finance by their banks, and other similar institutions, hedge funds, private equity and all other forms of borrowing, be it debt or equity where do they go?? They go to Collateral Transfer and the Demand Bank Guarantee.

Loss of Equity. You should remember that utilising a Demand Bank Guarantee is the same as borrowing debt, there is no loss of equity. This is highly significant when deciding whether a Bank Guarantee is worth the price.

Bank Guarantee Price

We have all heard the expression, “there is no such thing as a free lunch”. This applies to Demand Bank Guarantees as much as anything else in the financial world. However, anyone who is concerned about the cost must decide if the price is worth getting the project off the ground or not.

On average the cost of leasing a Demand Bank Guarantee in year 1 is circa 12.5% – 13.5%.

When leasing a Demand Bank Guarantee there are three sets of costs, (The Bank Guarantee Price), the beneficiary must take into consideration.

1. The fee charged by the Provider. A Demand Bank Guarantee is usually leased on a per annum basis. The fee charged by the provider to the beneficiary for this service is referred to as the Collateral Transfer Fee.

On average the cost per annum is 6%. However, the higher the investment grade rating of the issuing bank, the higher the Collateral Transfer Fee.

2. Cost of Borrowing – This represents the cost of one year’s lending by the lender to the beneficiary. Figures will be based on 12-month Libor or 12-month Euribor. These rates will vary from year to year as they are not fixed but subject to market fluctuations.

3. Arrangement Fees – These are fees charged by companies specialising in Collateral Transfer. They have a number of providers on their books and are therefore well placed to offer the beneficiary access to a Demand Bank Guarantee.

Typically, these fees are represented by legal fees, due diligence fees and booking fees. These fees are charged in the first year. If the beneficiary wishes to rollover the Demand Bank Guarantee into a second or third year, they will only be liable for the cost of borrowing and the Collateral Transfer Fee.

Conclusion

Many companies may feel that 13.5% in the first year is overly excessive compared to commercial lenders. However, if commercial lenders have rejected credit facility applications, as have private equity and other financial institutions then it becomes an excellent option.

So Collateral Transfer can be looked upon as a “Lender of the Last Resort”, and the pros outweigh the cons. Yes 13.5% is expensive, but the big advantage is that you can actually get the project off the ground. In all likelihood, a commercial bank may well lend against the project after the first year as it is now up and running. Another advantage is that you get to keep all the shares, with no loss of equity.

All in all, Collateral Transfer is a good deal. The first year is expensive but after that costs settle down and the project is off the ground. Do not be put off by the first year’s costs.

For more information on Bank Guarantees and Demand Bank Guarantees please click the link