Asset Based Lending

Key Facts

What is asset based lending?

Asset based lending is funding secured against a range of acceptable assets.

We can make an

introduction

We can introduce you to boutique finance companies that specialise in delivering corporate funding.

Free document download

facility

We have a range of useful documents and information to assist you with gaining finance for your projector company.

We can answer your

questions

We answer your questions in relation to Bank Guarantees. Click here to get the answers you need to make an informed decision.

If a company is short of funds or is cash flow negative, they can use asset based lending in a number of forms to obtain a line of credit against some of their assets. Generally acceptable assets are property, plant and equipment, (PP&E), inventory, accounts receivable and marketable securities and properties.

Some loans against assets are considered to be riskier than others. Physical assets for example are classed as higher risk as they cannot always be liquidated quickly. Whereas assets such as securities are low risk as they can be liquidated quickly.

Many of these asset-based loans are usually short term to cover payroll or the importation of goods to be on-sold. But where does a company go when they need to fund a project that is 2 to 5 years and they do not have the requisite funds or collateral?

Collateral transfer and asset based lending

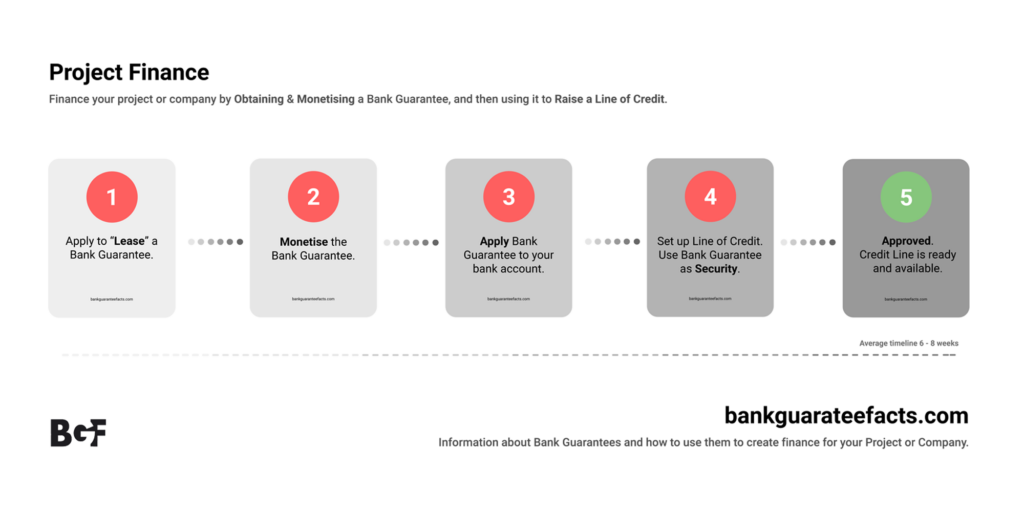

The definition of Collateral Transfer is the transfer of an asset from one company to another. If a company needs funding for a project and their bank have rejected their loan application then Collateral Transfer is the answer.

Collateral Transfer differs from asset based lending in that the asset is transferred to the company that requires the funding. The beneficiary uses that asset as security to obtain a credit line for construction finance, project finance or whatever specific project the company has proposed.

In this particular scenario, the asset is a Demand Bank Guarantee which is considered as first class collateral and is therefore so much easier to lend against. The reason for this is that the Demand Bank Guarantee is governed by ICC Uniform Rules for Demand Guarantees, (URDG 758) and is payable on first demand.

To many who have never heard of ICC Uniform Rules for Demand Guarantees, (URDG 758) this may as well be written in Latini. In simple terms if the borrower defaults, the bank that issued the Demand Bank Guarantee will cover any loss incurred.

For a full explanation on Demand Bank Guarantees and Collateral Transfer please click on the link.

Once a demand bank guarantee has been issued secured as a form of asset based lending process, then it can be monetised to raise a line of credit.

Important facts about the asset based lending process

- Collateral Transfer is not reinventing the wheel, in fact it has been around for decades. However, it has only become popular in the last two decades, and of course was highly popular during the Covid-19 pandemic.

- Collateral Transfer has for years been referred to as a Leased Bank Guarantee so this of course may not be news to many companies. Whilst it is an incorrect statement it is essentially correct, as the company providing the Bank Guarantee basically leases the instrument to the company requiring the Bank Guarantee.

- Many companies have asked how do we acquire a Demand Bank Guarantee? No doubt many internet searches have turned up many companies offering Bank Guarantees from USD/GBP/Euro 10 million to 5 billion or more. These companies should be avoided as set out below.

Problems frequently experienced when acquiring a credit line.

Beware of multi billion bank guarantee offers

When an offer is found on the internet for a USD 5 billion Bank Guarantee inevitably it is going to be false. Whilst a bank is the issuer of Bank Guarantees, it is their clients who are the providers of these financial instruments.

It is inconceivable that any company will be issuing a Bank Guarantee for USD5 billion. This infers that all the other offers from USD10 million upwards are certainly in doubt.

There are a number of companies who have decent reputations in the Bank Guarantee market. Only the very few are credible for not only providing their clients with a Demand Bank Guarantee, but arranging credit lines if they are rejected by their bankers.

For more information on where to go for this particular service we a can arrange an introduction to reputable companies about which we have received good feedback.

Business plans

It is important to remember that a lender may turn down a loan application even if offered a Demand Bank Guarantee as security. In many cases this is because the exit strategy within the business plan is weak.

This indicates to the lender that the borrower will be unable to repay the loan or line of credit on due date. It is therefore essential when applying for a Demand Bank Guarantee that the business plan contains a strong exit strategy.

The future

Statistics show that bank lending to non financial companies in 2020 was GBP35.5 billion of which GBP34.7 billion was lent at the start of the Covid-19 pandemic. Every single penny of these loans was guaranteed by the British government. Whilst the banks were not throwing money at clients, it made the asset based lending process a lot easier.

So what happens now that government support has been withdrawn? The smaller companies as usual will be suffering as the bigger more robust companies get the biggest slice of the lending pie?

Conclusions about asset based lending

It would appear the Bank Guarantee market or the collateral transfer market is set to rise once again. For those companies who need project finance via asset based lending, and who ave been unable to secure lines of credit, collateral transfer will provide much needed access to the requisite credit facilities.

2022 will be a hallmark year. As countries really start to recover from the Covid-19 pandemic the clamour for corporate loans and lines of credit will go through the roof. Many companies will be left behind and their only source of finance will be Collateral Transfer.